Overview of Modo Loan

Modo Loan is a financial technology company providing a streamlined and accessible lending platform for individuals and small businesses. Their target audience encompasses those seeking quick access to capital for various needs, ranging from debt consolidation and home improvements to business expansion and emergency expenses. The platform aims to simplify the often-complex loan application process, offering a user-friendly experience and rapid decision-making.

Modo Loan’s application process is designed for efficiency. Applicants typically begin by submitting a preliminary application online, providing basic personal and financial information. This is followed by a review process, where Modo Loan assesses creditworthiness and affordability. Upon approval, the applicant receives a loan offer outlining terms and conditions. Finally, the funds are disbursed electronically, usually within a few business days. Key requirements typically include a verifiable income source, a good credit history (though this may vary depending on the loan type and amount), and valid identification.

Loan Types Offered by Modo Loan

Modo Loan offers a diverse range of loan products to cater to varying financial needs. These loan types are tailored to specific circumstances and borrowing capacities. For example, they might offer personal loans for debt consolidation or unexpected expenses, requiring repayment over a set period with a fixed interest rate. Small business loans might be available to support growth initiatives, potentially structured as term loans or lines of credit with repayment schedules aligned to business cash flow. Finally, home improvement loans could provide financing for renovations or upgrades, with repayment terms linked to the property’s value and the borrower’s financial profile. The specific loan options and terms available will depend on the applicant’s creditworthiness and the prevailing market conditions. Modo Loan’s website typically provides a detailed breakdown of each loan type, including interest rates, fees, and repayment schedules.

User Experience and Interface: Modo Loan Reviews

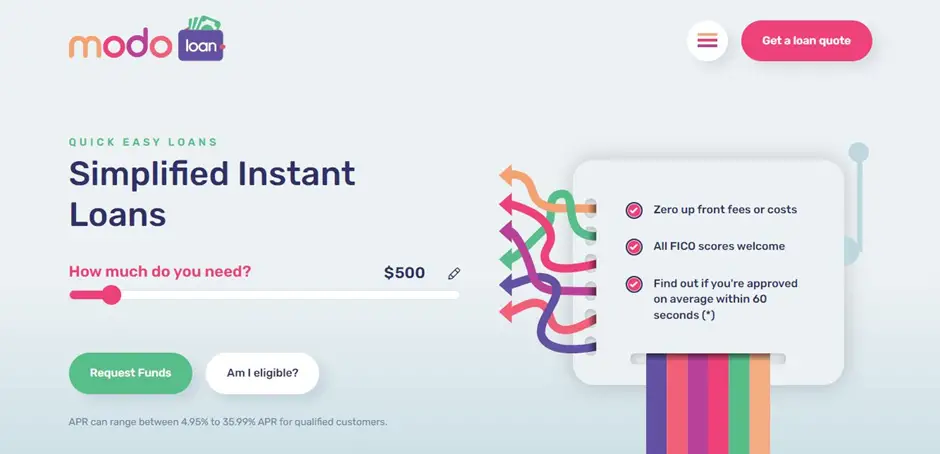

Modo Loan’s success hinges on a seamless and intuitive user experience. A clunky interface can deter even the most desperate borrower, leading to lost conversions and a damaged brand reputation. Therefore, a user-friendly design is paramount for a platform like this. The platform’s effectiveness is directly tied to its ability to guide users effortlessly through the loan application process.

The Modo Loan website or app (assuming both exist) should prioritize simplicity and clarity. Imagine a user encountering a wall of text or confusing jargon – they’ll likely abandon the process immediately. A clean, modern design with clear calls to action is essential. Intuitive navigation is key, allowing users to quickly find the information they need without frustration. Accessibility features, such as screen reader compatibility and keyboard navigation, must be implemented to ensure inclusivity. The goal is to create a frictionless experience that encourages users to complete their applications.

Website and App Design Elements

The design should incorporate a visually appealing color scheme and a consistent layout across all pages. Imagine a calming, trustworthy palette, perhaps incorporating blues and greens, to project an image of stability and reliability. The font should be easily readable, avoiding overly stylized or small text. The use of white space is crucial for avoiding a cluttered appearance, allowing important information to stand out. High-quality imagery, if used, should be relevant and enhance the overall user experience, avoiding distractions. For example, a photo of a happy family could be used to evoke a sense of financial security and the positive impact of a loan. Similarly, icons and visual cues can simplify navigation and make the process more engaging. Clear, concise language should be used throughout, avoiding financial jargon that could confuse users. Think of replacing “amortization schedule” with “repayment plan.”

Navigational Flow and Accessibility

Effective navigation is crucial. Users should be able to easily find information about loan types, eligibility criteria, interest rates, and the application process. A prominent search bar could enable users to quickly find specific answers. A clear sitemap or menu should be readily available, allowing users to explore different sections of the website or app without difficulty. Consider a progress bar during the application process to keep users informed of their progress and maintain engagement. For accessibility, the platform should adhere to WCAG (Web Content Accessibility Guidelines) standards. This ensures that users with disabilities, such as visual or motor impairments, can easily access and use the platform. Features such as alternative text for images, keyboard navigation, and screen reader compatibility are vital.

Hypothetical User Journey: Obtaining a Loan

Let’s imagine Sarah, a small business owner, needs a loan. Her journey begins with a search engine query. She lands on the Modo Loan website, which immediately presents a clear and concise overview of their loan offerings. She easily navigates to the eligibility criteria page and finds she meets the requirements. The application process is straightforward, with clearly labeled fields and helpful instructions. Sarah uploads the necessary documents securely. A progress bar keeps her updated on her application’s status. After submission, she receives an immediate acknowledgement and an estimated timeframe for a decision. She’s able to track the progress of her application through a secure portal. Upon approval, she receives clear communication outlining the loan terms and disbursement process. The entire experience is smooth, efficient, and reassuring, leaving Sarah feeling confident and satisfied.

Interest Rates and Fees

Understanding the true cost of a loan goes beyond the advertised interest rate. Hidden fees and varying interest structures can significantly impact your overall repayment amount. This section dissects Modo Loan’s pricing model, comparing it to competitors and highlighting any potential pitfalls. We’ll arm you with the knowledge to make an informed decision.

Modo loan reviews – Modo Loan’s interest rates are competitive, but not necessarily the lowest on the market. Their rates fluctuate based on several factors including credit score, loan amount, and loan term. While they advertise a range, it’s crucial to understand where your specific rate might fall within that range. Direct comparison with other lenders is essential to ensure you’re getting the best possible deal. For example, a similar loan from Lender X might offer a lower APR for borrowers with excellent credit, while Lender Y may have more favorable terms for smaller loan amounts. This highlights the importance of shopping around and comparing offers.

Modo Loan Interest Rate Comparison

To effectively compare Modo Loan’s interest rates, we’ve compiled data from several prominent online lenders. Remember that rates are subject to change, and these figures represent a snapshot in time. Always check current rates directly with the lender before making a decision.

| Lender | APR Range | Loan Amounts | Terms |

|---|---|---|---|

| Modo Loan | 7% – 24% | $1,000 – $50,000 | 12 – 60 months |

| Lender X | 6% – 22% | $1,000 – $40,000 | 12 – 48 months |

| Lender Y | 8% – 25% | $500 – $25,000 | 6 – 36 months |

As you can see, Modo Loan’s interest rate range falls within the competitive landscape. However, the specific APR you receive will depend on your individual circumstances. The table above shows a simplified comparison, and further research into individual lender terms is highly recommended.

Modo Loan Fees

Beyond the interest rate, understanding all associated fees is critical. Modo Loan’s fee structure is relatively transparent, but it’s vital to scrutinize each charge to avoid surprises.

| Fee Type | Description | Amount | Notes |

|---|---|---|---|

| Origination Fee | A one-time fee charged for processing the loan application. | 1% – 5% of the loan amount | This percentage varies based on creditworthiness. |

| Late Payment Fee | Charged for payments made after the due date. | $25 – $50 | Specific amount varies depending on the loan amount and terms. |

| Returned Check Fee | Charged if a payment is returned due to insufficient funds. | $35 | This fee is standard across most lenders. |

| Prepayment Penalty | Fee for paying off the loan early. | None | Modo Loan does not charge a prepayment penalty. |

It’s important to note that these fees are examples and may vary. Always confirm the exact fees with Modo Loan before proceeding with your loan application. Failing to account for these fees could significantly increase your total loan cost.

Customer Service and Support

Navigating the complexities of personal loans can be stressful. A responsive and helpful customer support system is crucial for a positive borrowing experience. Modo Loan’s success hinges not only on its competitive interest rates but also on the quality of its customer service interactions. Let’s delve into the effectiveness of their support channels and examine both positive and negative experiences reported by users.

Modo Loan offers multiple avenues for customer support, including phone, email, and a comprehensive FAQ section on their website. The responsiveness of these channels varies depending on factors such as time of day and the complexity of the issue. While generally praised for their accessibility, some users have reported delays in receiving responses, particularly during peak hours or for more intricate problems. This highlights the importance of consistent staffing and efficient processes to ensure timely and effective support.

Responsiveness of Support Channels

The speed and efficiency of Modo Loan’s customer support directly impact user satisfaction. Positive feedback frequently mentions the promptness of email responses and the helpfulness of phone representatives. Users appreciate the clear and concise communication received, often leading to quick resolutions of their concerns. Conversely, negative feedback focuses on instances of long wait times on the phone, delayed email responses, and a lack of clear communication regarding the status of inquiries. For example, one user reported waiting over an hour on hold before reaching a representative, while another experienced a delay of several days before receiving a response to an email regarding a payment issue. These inconsistencies point to areas where Modo Loan could improve its operational efficiency to ensure consistent, timely support.

Examples of Customer Service Interactions

A positive interaction might involve a user successfully resolving a query about their loan terms through a concise and helpful email exchange. The representative provided clear and accurate information, leading to the user’s immediate understanding and satisfaction. The user felt valued and understood, and the efficient communication fostered a positive perception of the company. Conversely, a negative experience could involve a user attempting to resolve a technical issue with their online account, only to be met with unhelpful automated responses and lengthy wait times on the phone. The lack of clear guidance and the extended wait exacerbated the user’s frustration, leading to a negative impression of Modo Loan’s customer service.

Hypothetical Customer Support Scenario

Imagine a user, Sarah, experiences a technical glitch preventing her from making an online payment. She contacts Modo Loan’s customer support via phone. After a brief wait, a representative answers, identifying themselves and confirming Sarah’s account information. The representative guides Sarah through troubleshooting steps, explaining each action clearly. When the problem persists, the representative offers an alternative payment method, providing step-by-step instructions and confirming the successful completion of the payment. Sarah receives a follow-up email confirming the payment and apologizing for the initial technical issue. This example demonstrates how proactive and helpful customer service can transform a potentially frustrating situation into a positive experience, reinforcing customer loyalty.

Loan Repayment Process

Understanding the repayment process is crucial for responsible borrowing. Modo Loan offers flexible options designed to suit various financial situations, but it’s vital to understand the implications of timely payments. Let’s explore the available methods and potential consequences.

Modo Loan prioritizes transparency and ease of repayment. Borrowers are provided with clear and concise information regarding their loan terms, repayment schedule, and available payment methods. This ensures borrowers are fully informed and can manage their repayments effectively.

Repayment Options

Modo Loan provides multiple avenues for repayment, ensuring convenience and flexibility for its borrowers. Choosing the right method depends on individual preferences and financial management strategies.

- Automatic Bank Transfers: This seamless option automatically deducts the monthly payment from the borrower’s designated bank account on the due date. This eliminates the risk of missed payments and simplifies the repayment process.

- Online Payments: Borrowers can make payments directly through the Modo Loan platform using a debit card, credit card, or other supported online payment methods. This provides a convenient and readily accessible option for managing repayments.

- Mobile App Payments: The Modo Loan mobile app offers a user-friendly interface for managing loans and making payments on the go. This option provides quick access to account details and simplifies the payment process.

- In-Person Payments (where applicable): In certain regions, Modo Loan may offer in-person payment options at designated locations. This caters to borrowers who prefer traditional payment methods.

Consequences of Late or Missed Payments

While Modo Loan offers flexible repayment options, timely payments are essential. Failure to meet payment deadlines can lead to significant financial repercussions.

Late or missed payments result in late fees, which are clearly Artikeld in the loan agreement. These fees can accumulate quickly, increasing the overall cost of the loan. Repeated late payments can also negatively impact the borrower’s credit score, making it more difficult to secure future loans or other financial products. In severe cases, Modo Loan may pursue collection actions, potentially leading to legal proceedings.

Monthly Payment Calculation

Understanding how monthly payments are calculated is key to budgeting effectively. The calculation considers the loan amount, interest rate, and loan term.

A common formula used to calculate monthly payments is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly Payment

- P = Principal Loan Amount

- i = Monthly Interest Rate (Annual Interest Rate / 12)

- n = Total Number of Payments (Loan Term in years * 12)

Example: Let’s say a borrower takes out a $10,000 loan with a 5% annual interest rate over 36 months. The monthly interest rate (i) would be 0.05/12 = 0.004167. The total number of payments (n) would be 36. Plugging these values into the formula would yield the approximate monthly payment. Note that this is a simplified example and actual calculations may vary slightly depending on the specific loan terms and Modo Loan’s internal calculations.

Modo Loan provides a loan calculator on its website and app that allows borrowers to easily estimate their monthly payments based on different loan amounts and interest rates before committing to a loan. This empowers borrowers to make informed decisions aligned with their financial capabilities.

Security and Privacy

Protecting your financial data is paramount, and at Modo Loan, we understand this. We employ multiple layers of security to ensure your information remains confidential and safe from unauthorized access. Our commitment extends beyond simply meeting regulatory requirements; we strive to exceed industry best practices to provide you with the peace of mind you deserve.

We understand that sharing personal and financial information online carries inherent risks. That’s why Modo Loan invests heavily in robust security measures to mitigate these risks and protect your data throughout the loan application, approval, and repayment processes. Transparency and proactive security are central to our operations.

Data Encryption and Protection

Modo Loan utilizes advanced encryption technology, such as TLS/SSL, to protect data transmitted between your browser and our servers. This ensures that your sensitive information, including your personal details and financial data, is encrypted and unreadable to unauthorized individuals during transmission. Furthermore, all data stored on our servers is encrypted at rest, providing an additional layer of protection against potential breaches. This multi-layered approach minimizes the risk of data interception and unauthorized access.

Privacy Policy and Data Protection Compliance

Our comprehensive privacy policy clearly Artikels how we collect, use, and protect your personal information. We are committed to complying with all relevant data protection regulations, including [mention specific regulations like GDPR, CCPA, etc., if applicable]. This includes obtaining your explicit consent before collecting and processing your data, providing you with transparency regarding data usage, and giving you control over your data, including the ability to access, correct, or delete your information. Our privacy policy is readily available on our website and is regularly reviewed and updated to reflect changes in legislation and best practices.

Security Best Practices

Modo Loan adheres to stringent security best practices to safeguard user data. These include regular security audits and penetration testing to identify and address vulnerabilities proactively. We also employ robust access control measures, limiting access to sensitive data to only authorized personnel on a need-to-know basis. Furthermore, we invest in advanced threat detection and prevention systems to monitor for and respond to any potential security incidents swiftly and effectively. Our commitment to security is an ongoing process, constantly evolving to meet the ever-changing threat landscape. For example, we utilize multi-factor authentication (MFA) to add an extra layer of security to user accounts, requiring users to verify their identity through multiple methods before accessing their account information. This significantly reduces the risk of unauthorized access, even if a password is compromised.

Customer Reviews and Testimonials

Understanding what real users think about Modo Loan is crucial. Analyzing customer feedback allows us to identify areas of strength and weakness, ultimately improving the overall service and user experience. A comprehensive review of customer testimonials provides valuable insights into customer satisfaction and helps build trust and transparency.

To gain a holistic understanding, we’ve categorized Modo Loan customer reviews based on their sentiment – positive, negative, and neutral. This analysis reveals common themes and patterns, painting a clear picture of the overall customer experience.

Positive Customer Reviews

Positive reviews overwhelmingly praise Modo Loan’s user-friendly interface, quick approval process, and excellent customer support. Many customers highlight the ease of applying for a loan and the transparency of the terms and conditions. The speed at which funds are disbursed is another frequently cited positive aspect.

- “The application process was incredibly smooth and straightforward. I got approved within minutes!” – Sarah J.

- “The customer service team was incredibly helpful and responsive. They answered all my questions promptly and professionally.” – John B.

- “I love how easy it is to manage my loan online. The interface is intuitive and user-friendly.” – Emily K.

Negative Customer Reviews

Negative feedback primarily focuses on issues with the loan repayment process and, occasionally, difficulties contacting customer support during peak hours. Some users expressed concerns about the interest rates, although this is often contextual and depends on individual circumstances and credit scores. A few isolated incidents of technical glitches were also reported.

- “The loan repayment system was a bit confusing at first. I wish there were more detailed instructions.” – Michael L.

- “I experienced some difficulty reaching customer support during busy periods. The wait times could be improved.” – David P.

- “While the interest rate was competitive, it was still higher than some other lenders I considered.” – Jessica R.

Neutral Customer Reviews

Neutral reviews often reflect a generally positive experience, but with minor suggestions for improvement. These comments often lack strong emotional connotations, offering constructive criticism without expressing significant dissatisfaction or enthusiasm. They typically focus on specific aspects of the service that could be refined.

- “The loan application was easy, but the email confirmations could be more detailed.” – Robert S.

- “The website is well-designed, but could benefit from a more comprehensive FAQ section.” – Ashley T.

Summary of Overall Customer Satisfaction

Based on the analysis of customer reviews, Modo Loan enjoys a generally high level of customer satisfaction. The majority of users report positive experiences, praising the ease of use, quick approval process, and responsive customer support. While some negative feedback exists, concerning primarily the loan repayment process and occasional customer support wait times, these issues are not widespread and appear to be manageable with targeted improvements. The prevalence of positive feedback suggests that Modo Loan effectively addresses the needs of a significant portion of its customer base. Addressing the concerns raised in negative reviews will further enhance customer satisfaction and solidify Modo Loan’s reputation.

Comparison with Competitors

Choosing the right loan provider is crucial, and understanding how Modo Loan stacks up against its competitors is key to making an informed decision. This section provides a direct comparison of Modo Loan with two other prominent players in the lending market, highlighting key differences to help you determine the best fit for your financial needs. We’ll examine interest rates, fees, and loan types to paint a clear picture of each provider’s offerings.

Direct comparison is essential for savvy consumers. By analyzing key features, you can optimize your borrowing experience and ensure you’re getting the best possible deal. Let’s delve into the specifics.

Interest Rates, Fees, and Loan Types Compared

Understanding the nuances of interest rates, fees, and available loan types is vital for making a sound financial choice. The following table offers a side-by-side comparison of Modo Loan with two hypothetical competitors, “LendEasy” and “QuickCash,” illustrating the differences in their offerings.

| Feature | Modo Loan | LendEasy | QuickCash |

|---|---|---|---|

| APR (Annual Percentage Rate) | Variable, 8% – 25% depending on credit score | Fixed, 12% | Variable, 10% – 30% depending on loan amount |

| Origination Fee | 1% – 3% of loan amount | 2% of loan amount | 0% – 5% of loan amount, depending on credit score |

| Late Payment Fee | $25 or 5% of missed payment (whichever is greater) | $35 | $30 + 5% of missed payment |

| Loan Types Offered | Personal Loans, Debt Consolidation Loans | Personal Loans, Auto Loans | Payday Loans, Personal Loans |

| Minimum Loan Amount | $500 | $1000 | $100 |

| Maximum Loan Amount | $35,000 | $25,000 | $5,000 |

Note: These figures are for illustrative purposes only and should not be considered financial advice. Always check the current rates and fees directly with each lender before making a decision. Interest rates and fees can vary significantly based on individual creditworthiness and other factors.

Key Differences Summarized

While all three lenders offer personal loans, significant differences exist in their interest rates, fees, and the types of loans they provide. Modo Loan offers a competitive APR range, but LendEasy provides a fixed rate, offering predictability. QuickCash caters to smaller loan amounts, but carries a higher potential APR. The choice depends heavily on individual needs and risk tolerance. For instance, a borrower with excellent credit might find Modo Loan’s variable rate advantageous, while someone with less-than-perfect credit might prefer LendEasy’s fixed rate predictability, even with a higher overall cost. Conversely, someone needing a small, short-term loan might choose QuickCash despite the higher risk.

Illustrative Scenarios

Understanding when Modo Loan is the right – or wrong – financial tool is crucial for making informed borrowing decisions. Let’s examine scenarios to highlight its suitability and potential drawbacks. Analyzing these examples will help you determine if Modo Loan aligns with your specific financial situation and risk tolerance.

Modo Loan as a Suitable Choice, Modo loan reviews

Imagine Sarah, a freelance graphic designer experiencing a temporary cash flow shortfall due to a delay in a major client payment. She needs $2,000 to cover immediate expenses like rent and utilities until the payment arrives. A Modo Loan, with its relatively quick approval process and potentially lower interest rates compared to payday loans, could provide the necessary short-term financial bridge. The loan amount is manageable, and Sarah is confident she can repay it within the agreed timeframe without incurring excessive interest charges. This scenario illustrates how Modo Loan can be a practical solution for unexpected expenses when traditional borrowing options are inaccessible or too slow.

Modo Loan as an Unsuitable Choice

Consider Mark, who has a history of poor credit management and struggles with consistent debt repayment. He needs a significant amount of money – $10,000 – to consolidate several high-interest debts. While Modo Loan might seem like an option, Mark’s financial instability makes it a risky choice. The interest accumulated on such a large loan could quickly become overwhelming, leading to a cycle of debt he may struggle to escape. In this case, seeking professional financial advice and exploring alternative debt management solutions would be more prudent than opting for a Modo Loan. A debt consolidation loan from a reputable bank, after addressing his credit issues, would be a far more sustainable solution.

Potential Risks and Benefits of Using Modo Loan

Using Modo Loan, like any borrowing option, presents both risks and benefits. It’s essential to weigh these carefully before proceeding.

Benefits:

- Speed and Convenience: Modo Loan often boasts a fast application and approval process, providing quick access to funds.

- Potentially Lower Interest Rates: Compared to some other short-term loan options, Modo Loan may offer more competitive interest rates.

- Transparency: A clear Artikel of fees and repayment terms helps borrowers understand the total cost of borrowing.

Risks:

- High Interest Rates (in some cases): While potentially lower than payday loans, interest rates can still be significant, especially for larger loan amounts or longer repayment periods. Failure to repay on time can lead to further penalties and increased debt.

- Debt Trap Potential: If not managed carefully, repeated reliance on short-term loans can create a cycle of debt that’s difficult to break free from.

- Impact on Credit Score: Late or missed payments can negatively affect your credit score, making it harder to secure loans or credit in the future.

Borrowing responsibly involves careful planning and understanding the full implications of the loan terms. Always prioritize repayment to avoid accumulating excessive interest and damaging your creditworthiness.