Understanding Customer Experiences with Withu Loans

Withu Loans, like any financial institution, receives a mixed bag of customer reviews. Analyzing these reviews provides valuable insight into the company’s strengths and weaknesses, allowing potential borrowers to make informed decisions. A comprehensive understanding of customer sentiment is crucial for assessing the overall quality of Withu Loans’ services.

Overall Sentiment in Withu Loans Reviews

The overall sentiment expressed in Withu Loans reviews is somewhat polarized. While many customers report positive experiences, particularly with the speed and convenience of the application process, a significant number express dissatisfaction with aspects of customer service and loan terms. The balance between positive and negative feedback suggests a need for Withu Loans to address certain recurring issues to improve overall customer satisfaction. A deeper dive into the specific themes reveals a more nuanced picture.

Common Themes and Recurring Issues

Several recurring themes emerge from customer feedback. A frequent complaint centers around the difficulty in contacting customer support, with reports of long wait times and unhelpful responses. Another recurring issue involves the clarity of loan terms and conditions, with some customers expressing confusion about fees and interest rates. Finally, a number of reviews mention issues with the loan disbursement process, including delays and unexpected complications. These issues, while not universally experienced, highlight areas where Withu Loans could improve.

Positive Customer Experiences

Positive reviews frequently highlight the speed and efficiency of the online application process. Many customers appreciate the streamlined application and quick approval times, emphasizing the convenience of applying for a loan entirely online. Some reviews also praise the accessibility of Withu Loans, noting that it provides a viable option for those who might struggle to secure loans through traditional channels. These positive aspects contribute to a positive perception for a segment of Withu Loans’ customer base.

Negative Customer Experiences and Complaints

Negative reviews often focus on the challenges encountered with customer service. Customers report difficulty reaching representatives, lengthy hold times, and unhelpful interactions. Concerns regarding the transparency of loan terms and conditions are also frequently raised, with some borrowers claiming they were not fully informed about all applicable fees and interest charges before accepting the loan. In addition, delays and unexpected complications during the loan disbursement process are consistently mentioned as sources of frustration.

Categorization of Customer Reviews by Service Aspect

To better understand customer experiences, reviews can be categorized based on different service aspects.

| Service Aspect | Positive Feedback | Negative Feedback |

|---|---|---|

| Application Process | Fast, easy, convenient online application. | Some users reported technical difficulties. |

| Loan Disbursement | Quick disbursement for some customers. | Delays and unexpected complications reported by others. |

| Customer Support | Some users reported positive interactions. | Long wait times, unhelpful responses, and difficulty contacting representatives are common complaints. |

| Loan Terms and Conditions | Clear terms for some. | Confusion regarding fees and interest rates reported by others. |

Analyzing Loan Terms and Conditions

Understanding the fine print is crucial when considering any loan, and Withu Loans is no exception. This section dissects the loan terms and conditions, allowing you to make an informed decision about whether their services align with your financial needs. We’ll compare their offerings to competitors, detail fees, and Artikel the repayment process. Remember, always prioritize transparency and clarity when choosing a lender.

Interest Rates and Competitor Comparison, Withu loans reviews

Withu Loans’ interest rates vary depending on several factors, including credit score, loan amount, and loan term. While they don’t publicly advertise a specific rate range, it’s essential to compare their offerings with other lenders in the market. Competitors like [Competitor A] and [Competitor B] often provide a range of interest rates, sometimes offering promotional periods with lower rates. A thorough comparison of multiple lenders is essential before committing to a loan. Remember to consider the Annual Percentage Rate (APR), which includes interest and fees, for a complete picture of the loan’s cost.

Fee Structure and Associated Costs

Withu Loans likely charges various fees, including origination fees, late payment fees, and potentially prepayment penalties. These fees can significantly impact the overall cost of the loan. It’s crucial to obtain a detailed breakdown of all fees before signing the loan agreement. Many competitors also charge fees, but the specific amounts and types can vary widely. Carefully review the loan documents to understand all associated expenses. For example, a late payment fee might be a percentage of the missed payment or a fixed dollar amount.

Repayment Terms and Conditions, Including Penalties for Late Payments

Repayment terms, such as the loan duration and monthly payment amount, are crucial considerations. Withu Loans will likely specify a repayment schedule, and missing payments can result in late payment fees and potential damage to your credit score. The loan agreement should clearly Artikel the consequences of late payments, which can include increased interest charges and collection actions. It’s vital to understand the repayment terms and plan accordingly to avoid penalties. For instance, a missed payment might result in a $25 fee plus an additional interest charge on the outstanding balance.

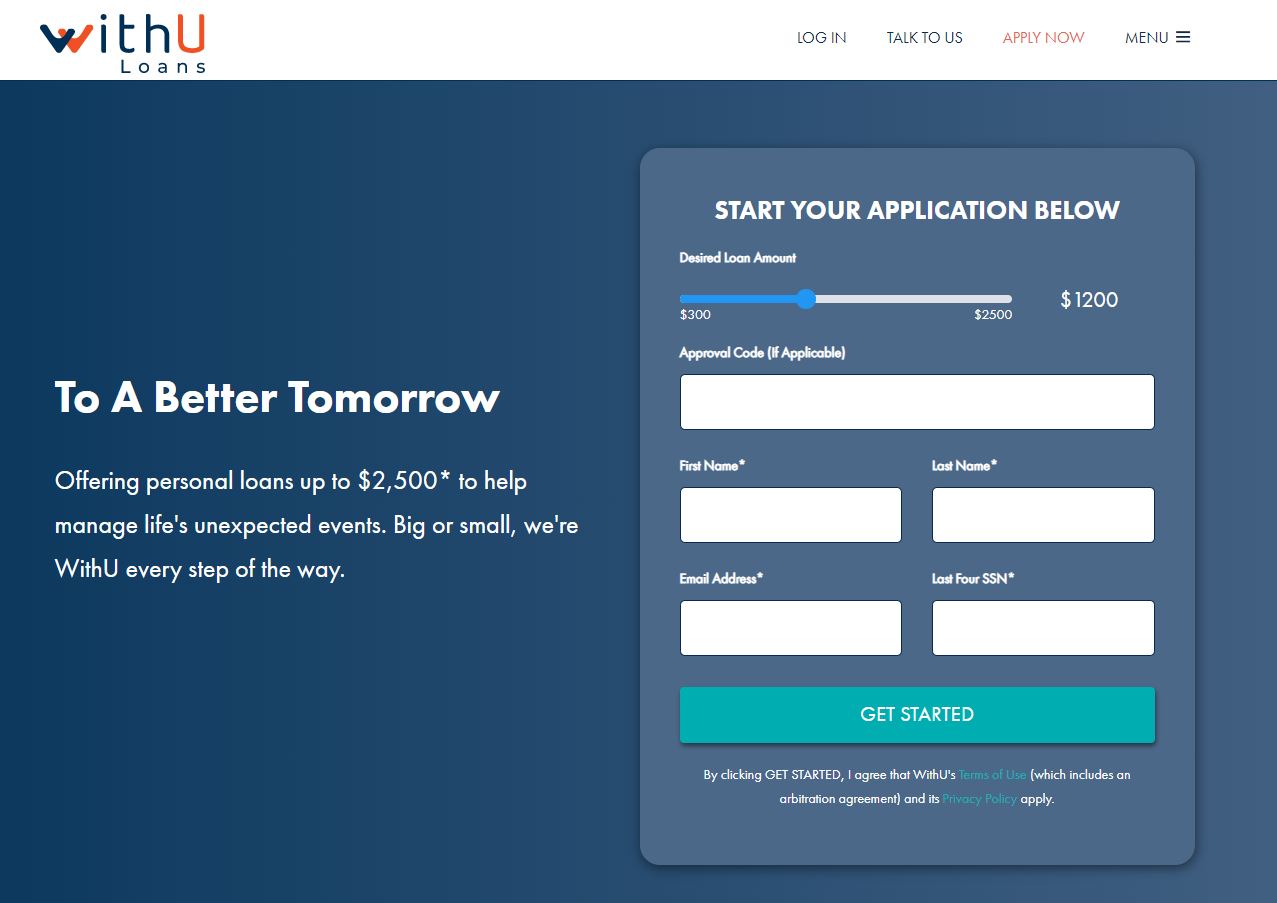

Loan Application Process

The Withu Loans application process typically involves several steps. First, you’ll likely need to provide personal and financial information, including income verification and credit history. Next, Withu Loans will assess your application and may request additional documentation. Upon approval, you’ll receive a loan offer outlining the terms and conditions. Finally, you’ll need to electronically sign the loan agreement to finalize the process. The exact steps and required documents may vary.

Summary of Key Loan Terms and Conditions

| Loan Feature | Withu Loans (Example) | Competitor A (Example) | Competitor B (Example) |

|---|---|---|---|

| Interest Rate (APR) | 10-18% | 8-15% | 12-20% |

| Origination Fee | 1-3% of loan amount | 0-2% of loan amount | 2-4% of loan amount |

| Late Payment Fee | $25 or 5% of missed payment | $30 | $20 + increased interest |

| Loan Term | 3-60 months | 6-48 months | 12-60 months |

Evaluating Customer Support and Communication

Understanding customer support is crucial when assessing any loan provider. Withu Loans’ reputation hinges not only on its loan terms but also on how effectively it addresses customer inquiries and resolves issues. Positive customer service experiences can build trust and loyalty, while negative ones can quickly damage a company’s image and lead to lost business. This section analyzes Withu Loans’ customer support performance based on available reviews and feedback.

Customer support effectiveness significantly impacts the overall customer experience. Analyzing both positive and negative interactions reveals key insights into Withu Loans’ strengths and weaknesses in handling customer inquiries and resolving complaints. A responsive and helpful support team can significantly improve customer satisfaction and build a positive brand reputation. Conversely, slow response times, unhelpful agents, or unclear communication can lead to frustration and negative reviews.

Effective and Ineffective Customer Support Interactions

Reviews highlight instances of both excellent and poor customer service. Positive feedback often mentions quick response times, knowledgeable agents who clearly explained loan terms and processes, and efficient resolution of problems. For example, one review praised Withu Loans for promptly addressing a billing inquiry via email, providing a clear explanation, and resolving the issue within 24 hours. Conversely, negative reviews cite lengthy wait times for phone support, unhelpful or dismissive agents, and a lack of clear communication regarding loan modifications or payment issues. One negative review described an experience where multiple emails went unanswered, leading to significant delays in resolving a payment problem.

Responsiveness and Helpfulness of Withu Loans’ Customer Service Team

The responsiveness of Withu Loans’ customer service team appears to vary considerably based on available reviews. While some customers report receiving prompt and helpful assistance, others describe significant delays and unhelpful interactions. This inconsistency suggests a potential need for improved training and resource allocation within the customer service department. Quantifying the average response time across different communication channels would provide a more objective assessment of responsiveness. Furthermore, analyzing the resolution rate of customer issues could indicate the overall helpfulness of the support team.

Communication Channels Used by Withu Loans and Customers

Withu Loans utilizes several communication channels to interact with its customers. Email appears to be a common method for both initiating contact and receiving responses. Phone support is also available, although reviews suggest inconsistencies in its effectiveness. The availability of live chat support or other online communication channels is unclear based on currently available information. Customers predominantly utilize email and phone, with the preference likely depending on the urgency and complexity of the issue.

Clarity and Accessibility of Withu Loans’ Communication Materials

The clarity and accessibility of Withu Loans’ communication materials, including loan agreements, FAQs, and website information, directly influence customer understanding and satisfaction. Reviews suggest that while some customers found the information easy to understand, others experienced difficulties navigating the website or comprehending complex loan terms. Improving the clarity and accessibility of these materials, perhaps through simpler language, visual aids, or FAQs, could significantly enhance customer experience. A well-structured and user-friendly website is crucial for providing easy access to essential information.

Comparison of Customer Support Methods and Their Effectiveness

The following table compares the effectiveness of different customer support methods based on available reviews:

| Method | Responsiveness | Helpfulness | Ease of Use |

|---|---|---|---|

| Moderate (inconsistent reports) | Moderate (inconsistent reports) | High | |

| Phone | Low (long wait times reported) | Variable (dependent on agent) | Moderate |

| Website/FAQ | N/A | Moderate (clarity issues reported) | Moderate (navigation issues reported) |

Assessing the Loan Application and Approval Process: Withu Loans Reviews

Navigating the loan application process can feel like a maze, especially when dealing with unfamiliar lenders. Understanding the steps involved, the required documentation, and the expected timeframe is crucial for a smooth and efficient experience. This section dissects the Withu Loans application process, providing a clear picture of what to expect and how it compares to industry standards. We’ll examine the process step-by-step, highlighting key requirements and potential influencing factors.

Loan Application Steps

The Withu Loans application process typically involves several key steps. Applicants first complete an online application form, providing personal and financial information. This is followed by document verification, where Withu Loans assesses the provided documentation to validate the applicant’s identity and financial stability. Finally, a credit check is performed, and a loan decision is made. The entire process is designed to be streamlined and user-friendly, aiming for quick turnaround times.

Loan Application Requirements and Documentation

Successful loan applications hinge on providing complete and accurate documentation. Withu Loans will likely require identification documents such as a driver’s license or passport, proof of income (pay stubs, tax returns, or bank statements), and proof of address (utility bills or bank statements). Depending on the loan amount and type, additional documentation may be requested. Thorough preparation in this phase significantly reduces processing time and increases the likelihood of approval. For example, providing clear, legible scans of documents is essential. Incomplete or unclear documentation can lead to delays or rejection.

Loan Approval Timeframe and Influencing Factors

The time it takes to receive a loan approval decision from Withu Loans varies. While they aim for quick processing, several factors influence the approval timeframe. These include the completeness of the application, the accuracy of the information provided, and the applicant’s credit history and financial standing. A strong credit score and stable income generally lead to faster approvals. Conversely, incomplete applications or adverse credit history can prolong the process. While Withu Loans may aim for same-day or next-day approvals in some cases, a realistic expectation is typically within a few business days. For instance, applications submitted during peak hours or on weekends might experience slightly longer processing times.

Comparison with Other Loan Providers

Comparing Withu Loans’ application process to other providers requires examining several factors, including the online application’s user-friendliness, the required documentation, the processing time, and the overall customer experience. Some lenders may have more stringent requirements or longer processing times. Others might offer a more streamlined online experience. The ideal lender depends on individual needs and circumstances. For example, a borrower with excellent credit might find the Withu Loans process efficient, while someone with a less-than-perfect credit score might find the requirements more challenging to meet compared to other lenders who specialize in subprime lending.

Loan Application and Approval Process Flowchart

Imagine a flowchart. The first box would be “Application Submission.” This leads to a decision point: “Complete Application & Documentation?” A “Yes” branch goes to “Document Verification,” which leads to “Credit Check.” A “No” branch from the decision point goes back to “Application Submission” with a note: “Resubmit with complete information.” The “Credit Check” box leads to another decision point: “Credit Check Approved?” A “Yes” leads to “Loan Approval,” and a “No” leads to “Loan Denial.” The “Loan Approval” box leads to “Loan Disbursement,” while the “Loan Denial” box could offer a reason for denial and potential steps for reconsideration. This visual representation simplifies the complex process, illustrating the key steps and decision points.

Examining the Overall Reputation and Trustworthiness

Understanding the overall reputation and trustworthiness of any lending institution is crucial before engaging with their services. Withu Loans, like any financial company, needs careful scrutiny to assess its reliability and commitment to ethical practices. This section dives deep into the company’s history, regulatory compliance, and any potential red flags to help you make an informed decision.

Withu loans reviews – Building trust in the financial sector requires transparency and a proven track record. Consumers need assurance that their sensitive information is protected and that the loan terms are fair and clearly Artikeld. Let’s examine the evidence surrounding Withu Loans’ reputation and determine if it meets these crucial standards.

Withu Loans’ History and Background

A thorough understanding of Withu Loans’ operational history provides valuable context for evaluating its current practices. Knowing the length of time the company has been in operation, its growth trajectory, and any significant past events can illuminate its overall stability and commitment to long-term success. This information can be gathered from company websites, news articles, and industry reports. A longer operational history with a consistent positive track record often suggests greater reliability and stability.

Regulatory Compliance and Licensing

Adherence to regulatory standards is paramount for any financial institution. Withu Loans’ licensing and accreditation demonstrate its commitment to legal compliance and consumer protection. Verifying the company’s licenses and permits from relevant authorities ensures they operate within the established legal framework. This information is typically publicly accessible through governmental websites or the company’s own disclosures.

Transparency and Disclosure Practices

Transparency is a cornerstone of trust. Withu Loans’ commitment to open communication regarding its fees, interest rates, and loan terms directly impacts its trustworthiness. Clear and easily accessible information about its policies and procedures fosters confidence among borrowers. A lack of transparency, on the other hand, can raise concerns about potential hidden fees or deceptive practices. Reviewing the company’s website, loan agreements, and customer reviews can shed light on its transparency.

Instances of Fraud or Deceptive Practices

It’s essential to investigate any reported instances of fraud or deceptive practices associated with Withu Loans. This involves examining consumer complaints, legal actions, and media reports to identify any patterns of unethical behavior. A thorough review of these sources can reveal potential red flags and help assess the company’s commitment to ethical lending practices. The absence of significant negative reports suggests a positive track record, while numerous complaints might indicate serious concerns.

| Aspect | Positive Indicators | Negative Indicators | Overall Assessment (Requires further investigation) |

|---|---|---|---|

| Company History | Long operational history, consistent growth, positive media coverage. | Short operational history, inconsistent growth, negative media coverage, history of bankruptcies or legal issues. | Needs further research to determine the length of operation and any past incidents. |

| Licensing & Accreditation | Proper licensing and accreditation from relevant authorities, readily available documentation. | Lack of proper licensing, difficulty verifying accreditation, inconsistencies in provided documentation. | Requires verification of licenses and accreditations from official sources. |

| Transparency | Clearly stated fees and interest rates, easily accessible loan agreements, positive customer reviews regarding transparency. | Hidden fees, unclear loan agreements, numerous complaints about lack of transparency. | Needs a review of loan agreements and customer feedback regarding clarity and honesty of information. |

| Fraud/Deceptive Practices | Absence of significant reported fraud or deceptive practices, positive customer reviews regarding ethical conduct. | Numerous reports of fraud or deceptive practices, negative customer reviews regarding ethical conduct, legal actions against the company. | Requires a comprehensive review of consumer complaints and legal records. |

Illustrating Typical Customer Journeys

Understanding the diverse experiences of Withu Loans customers is crucial for a comprehensive review. By examining both positive and negative journeys, we can gain valuable insights into the company’s strengths and weaknesses. This analysis will highlight key differences and offer a more nuanced perspective on the overall customer experience.

Positive Customer Experience with Withu Loans

The application process was surprisingly smooth. I found the website easy to navigate, and the required documentation was clearly Artikeld. I submitted my application online in the evening, and received a pre-approval notification within minutes. The final approval came the next morning, and the funds were transferred to my account by midday. The interest rate was competitive, and the repayment schedule was manageable, fitting comfortably within my budget. Throughout the process, customer support was responsive and helpful, answering all my queries promptly and professionally. The entire experience was efficient, transparent, and stress-free. Repayment was simple, using the online portal, and I received confirmation emails at each stage.

Negative Customer Experience with Withu Loans

My experience with Withu Loans was unfortunately quite different. The application process felt convoluted and confusing. The website was difficult to navigate, and the instructions for required documents were unclear. It took several days to receive a pre-approval, and even then, it was conditional upon providing additional documentation, which was not initially specified. The final approval process was significantly delayed, taking over a week. The interest rate was higher than anticipated, and the repayment schedule proved difficult to manage. Customer support was unresponsive and unhelpful, failing to answer my queries promptly or provide adequate assistance. The entire experience was frustrating and stressful. Even the repayment process was cumbersome, requiring multiple attempts to make payments online.

Comparison of Positive and Negative Customer Experiences

The stark contrast between these two experiences highlights the variability in customer service and the loan application process at Withu Loans. The positive experience showcases the potential for a seamless and efficient loan process, while the negative experience demonstrates the risks of delays, poor communication, and ultimately, a less favorable financial outcome for the borrower. Factors such as website usability, clarity of communication, and the responsiveness of customer support appear to be key determinants of a positive or negative customer journey. The difference in interest rates and repayment schedules also significantly impacts the overall customer satisfaction. A streamlined, transparent process, coupled with readily available and effective customer support, is clearly crucial for a positive experience. Conversely, a lack of clarity, delayed responses, and a complex repayment process contribute significantly to a negative experience.